Our blog.

Most popular articles.

AI and Automation

5 min read

Introducing the Puzzel Virtual Agent Suite: Transforming Customer Engagement with AI.

By:

Gabi Warren

Press & Media

5 min read

New survey reveals top 2025 trends: 65% of CX leaders see AI as essential for reducing agent burnout.

By:

Gabi Warren

AI and Automation

Agent Experience

5 min read

Balancing AI and human empathy: Why soft skills matter in customer service.

By:

Jeanine Desirée Lund

Latest articles.

Cloud transformation

5 reasons to make the switch to cloud-based contact centre technology

AI and Automation

What virtual agents need to perform at their best: 5 best practices

CX strategy

From Conversations to Competitive Advantage: Unlocking the Power of Conversational Intelligence

AI and Automation

Why your customer conversations are your most underused CX asset

Cloud transformation

Still on-prem? Here’s what it might be costing your contact centre

AI and Automation

Manual call tagging is still eating up time — here’s how teams are taking it back

AI and Automation

Introducing Conversational Intelligence: AI-powered insights that elevate every customer conversation

AI and Automation

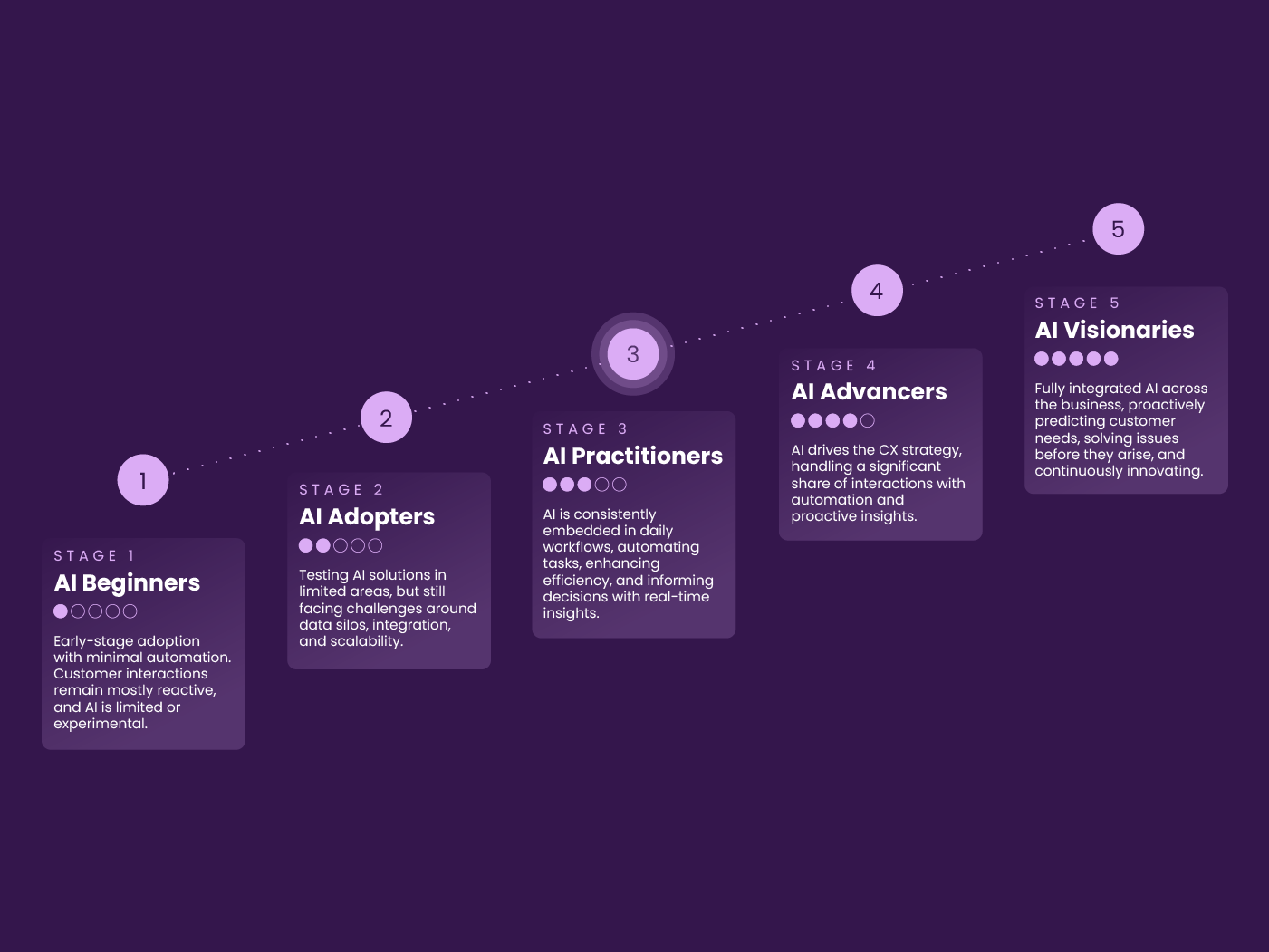

Where does your contact centre fall on the AI maturity curve?

Customer Experience

Connected conversations: How to deliver seamless customer experiences at scale

AI and Automation

AI in customer service: A beginner’s guide for CX leaders

AI and Automation

4 common barriers to AI adoption in the contact centre and how to overcome them

Cloud transformation